Mortgage Professionals Database for Act! Premium Subscription

$300.00

SUBSCRIPTION SOLD SEPARATELY

This product is for customers purchasing an Act! Premium Subscription or those currently on an Act! Premium Cloud or Act! Premium Desktop Subscription who want to add an industry specific database.

Specifically designed for residential mortgage professionals.

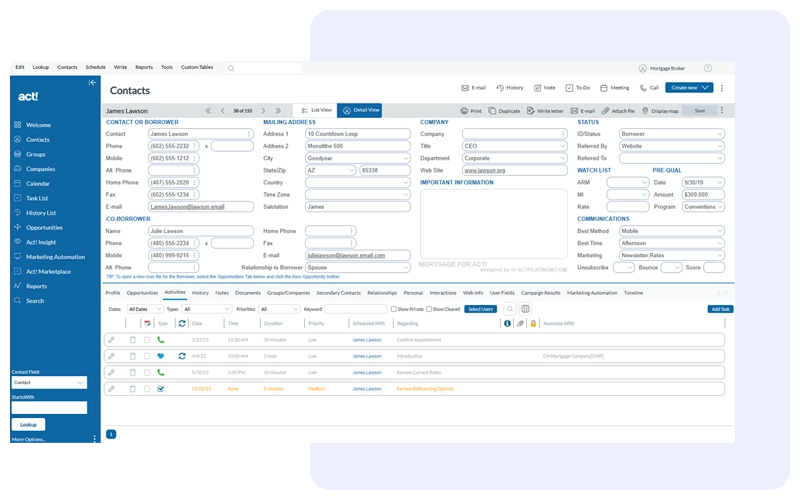

Mortgage Database for Act! is a customized Act! Premium CRM v26 database for the residential mortgage industry. Centralize Borrower, Co-Borrower and Loan Information for Easy Organization. Keep contact information at your fingertips using a database and corresponding layouts designed specifically for mortgage professionals.

CLICK ON THE DESCRIPTION BOX BELOW TO EXPAND FOR MORE INFORMATION.

Your purchase includes 1 download of the Mortgage Professional Database and restore instructions. You will also be given a link to instructions for importing an existing Act! database to the Mortgage Professional Database. If you need help with importing, services are available at an additional cost.

You will need to purchase 1 per account.

Description

CLICK HERE to learn more about Residential Mortgage customized database for Act! Premium CRM

TRY BEFORE YOU BUY – Click Here to go to our online test drive of the Residential Mortgage Database.

DATABASE FEATURES

CRM FOR MORTGAGE TRACK BORROWERS AND CONTACTS |

Keep important contact details on your Borrowers & Co-Borrowers, referral information and key watch list items of Interest Rate, ARM and MI Expiration Dates. You will also have the standard Act! CRM Features of Notes, Histories, Activities and Calendaring, Documents, Secondary Contacts, Contact Relationships and More! |

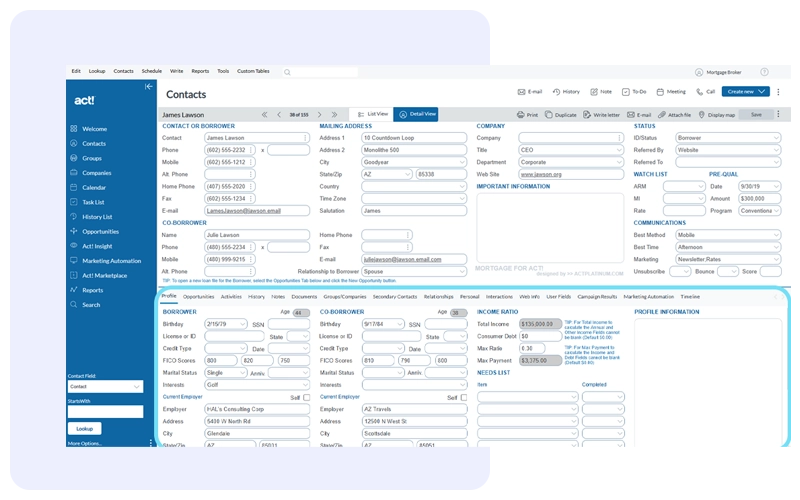

BORROWER AND CO-BORROWER INFORMATION

|

Track Borrower & Co-Borrower’s Birthday, Social Security Number, FICO Scores and Family information. Enter their Employer and income details and Act! will automatically calculate the Total Income, enter a Max Ratio and it will calculate a Max Payment. |

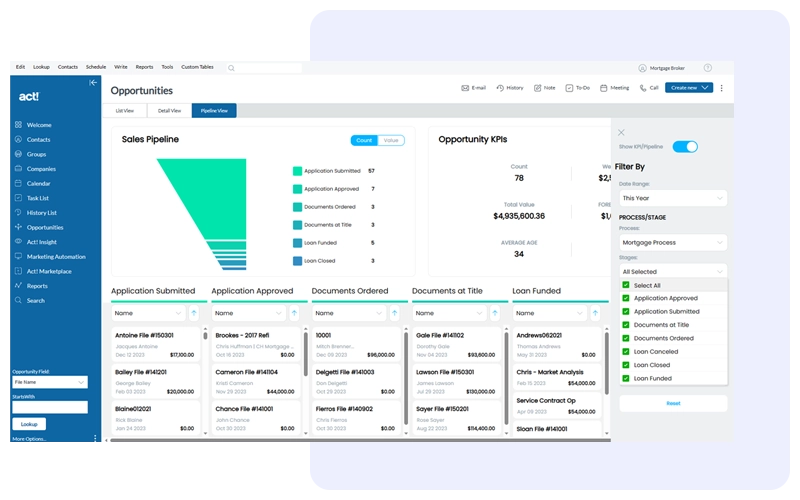

LOANS IN PROCESS |

Stay on top of your Loan Pipeline by using the Opportunities in Act! to track property loan information including loan details, key in-process dates and loan status. Mortgage Brokers, Loan Officers, Assistants and Processors can all work within the same loan records, share notes, make updates, see each file’s progress and current status. |

LOAN DETAILS |

Enter the details on 1st, 2nd and/or Existing Loans for each transaction. Keep track of loan interest rate, lock date and associated loan fees. |